Corporate Governance

Here, we describe our corporate governance system and initiatives.

- Basic Policy on Corporate Governance

- Basic Approach to Corporate Governance

- Report on Corporate Governance

- Compliance Promotion and Anti-Corruption

Basic Policy on Corporate Governance

Preamble: Positioning of the Basic Policy on Corporate Governance. The ANEST IWATA Group's approach to corporate governance and related policies are stated herein, based on the Group Management Policy and Group Management Vision. Regulations shall be newly established and revised in accordance with this policy. Also, this policy shall be reviewed at least once a year, and deliberated by the Board of Directors.

- Article 1. Prerequisite Policies for Corporate Governance

-

- 1. Primary Responsibility

- The Company shall recognize that maintaining and improving the quality of products and services bearing the ANEST IWATA name is of the utmost importance to the Group as a manufacturer. The Company shall provide safe, high-quality products and services at reasonable prices based on an accurate understanding of customer needs.

- 2. Appropriate Cooperation with Stakeholders

- The Company shall cooperate with various people and companies surrounding the Group as appropriate, in order to achieve sustained growth and to create medium- to long-term corporate value.

- 3. Contribution to Society

- The Company shall recognize that it is a member of society, and aim to be a creative company that benefits society.

- 4. Securing the Rights of Shareholders

- The Company shall emphasize equal treatment of shareholders, and maintain an environment in which shareholders can exercise their rights appropriately. The Company shall also strive to engage in constructive dialogue with shareholders.

- Article 2. Basic Policy

-

- Product Development

- The Company shall aim to develop high-performance, high-quality, and safe products that meet customer needs. The Company shall prioritize the utilization of the Group's process capabilities and technical expertise, but it shall also cooperate flexibly with various other companies as necessary.

- Fair Trade

- The Company shall cooperate with various people and companies surrounding the Group as appropriate, in order to achieve sustained growth and to create medium- to long-term corporate value.

- Ensuring Diversity

- The Company shall work to ensure diversity, in order to create new value and achieve sustainable growth.

- Internal Controls

- We shall establish and implement internal controls on a continuous basis to ensure effective and efficient business operations and the credibility of reporting, comply with laws and other legal requirements and protect our assets.

- Health and productivity management

- The Company shall promote health maintenance and improvement activities to attain our health goal – to ensure that all the people working in our group and their families live happily and healthily. The Company shall create a corporate culture and environment that make it easy for each individual to engage in these activities.

- Risk Management

- The Company shall analyze and evaluate various risks that may adversely affect the Group, and take appropriate measures.

- Information Security

- The Company shall recognize the importance of information security, and build up a system to prevent its loss and leakage.

- Protection of Personal Information

- By emphasizing the importance of the protection of personal information, the Company shall collect and use personal information in an appropriate manner, and prevent its loss and leakage.

- The Environment

- The Company shall recognize that its activities regarding global environmental issues are a social mission, and it shall strive to reduce the burden on the environment by establishing environmental policies. The Company shall also contribute to society by working to develop products aimed at reducing the environmental impact of its customers.

- Financial Reports

- The Company shall comply with corporate accounting standards that are generally accepted as fair and valid, and provide financial reports in which its financial statements and information that may affect its financial statements are shown in an appropriate manner.

- Information Disclosure

- Information that is deemed useful to external stakeholders, including non-financial data, shall be actively disclosed without being limited to disclosure items mandated by laws and regulations. The Company shall also establish a system that prevents insider trading.

- Cross Shareholding

- The Company shall hold listed shares if it is deemed conducive to the sustained enhancement of the Group's corporate value. Also, the purpose and reasons for the holding shall be reviewed by the Board of Directors every year. Whether to exercise voting rights shall be judged based on whether or not the content is in keeping with the purpose of the holding.

- Shareholders' Equity

- The Company shall aim for a return on equity (ROE) of 10% or higher as an appropriate level with which to establish a sound financial base that will allow for investment and risk tolerance necessary for the Group's sustained growth.

- Using and Paying Dividends of Surplus

- The Company shall pay out steady dividends backed by business performance, keeping in mind investments necessary for realizing long-term profit. A dividend payout ratio of 30% (based on consolidated net income) shall be the standard, and the Company shall maintain a minimum annual dividend of JPY 3 per share.

- De Facto Shareholders

- The voting rights exercisable at the Shareholders' Meeting shall be held by the shareholders registered in the list of shareholders. However, a de facto shareholder may attend the Shareholders' Meeting if they make a request in advance through the nominal shareholder on the list of shareholders.

- Takeover Defense Measures

- The Company shall establish so-called takeover defense measures. However, these measures shall serve the common interests of the shareholders and must not be intended to protect Directors, etc.

- Article 3. Management Structure of the Company

-

- Institutional Structure

- Since the Company believes that appointing an Audit & Supervisory Committee member as a Director with voting rights to the Board of Directors will lead to more effective oversight of the Board of Directors as well as improvements in management efficiency, the Company shall take the form of a company with an Audit & Supervisory Committee.

- Board of Directors

- Of the ten Directors, five or more shall be from outside the company, in order to ensure effective oversight of the Directors.

- Audit & Supervisory Committee

- The Company shall build a system that allows for wide-ranging internal oversight of the company while staying independent and objective by placing Outside Directors, who are in fully independent positions, at the center, and placing insiders with thorough knowledge of the internal workings of the company alongside them.

- External Accounting Auditor

- The Company shall recognize that external accounting auditors are answerable to society, and shall ensure a system in which external accounting auditors can perform audits in an appropriate manner.

- Arbitrary committees

- AAs advisory panels for the board of directors, a nominating and compensation committee shall be created, both formed by the representative director and outside directors and chaired by an outside director, to strengthen the governance function by making decision-making procedures regarding nomination and compensation more transparent and checking the arbitrary decisions of the representative director. Also, an internal controls committee shall be put in place to complement the functions of the board of directors.

- Internal Audit Department

- An Internal Audit Department shall be set up independent of the parts of the organization engaged in business execution, in order internally audit the business conducted by the Company and affiliated companies.

- Article 4. Responsibilities of the Company's Board of Directors and Directors

-

- Analyze and Evaluate Effectiveness

- The Directors shall regularly analyze and evaluate the effectiveness of the entire Board of Directors.

- Utilize Experts

- All Directors, when carrying out their duties as Directors, shall actively utilize and consider the opinions of outside experts, such as consultants and lawyers, in deliberating matters that are judged to require the opinions and perspectives of third parties. The Company shall bear the full cost incurred in connection with such activities.

- Nurture Successors

- The Company shall nurture successors who will lead the business in the future. The situation shall be checked regularly, and reviewed in a timely manner.

- Educate Directors

- The Company shall educate its Directors continuously regarding their roles, responsibilities, and the knowledge necessary. The Company shall also provide Outside Directors with sufficient information about the Group's business.

- Transactions Between Interested Parties

- When conducting a competitive transaction or a transaction involving a conflict of interest with a Director or a corporate entity substantially controlled by a Director, the Board of Directors must approve of it in advance.

- Directors Holding Concurrent Positions

- No Director shall hold a notable concurrent position for which they cannot fulfill the responsibilities in full.

- Compensation for Directors

- Compensation for Directors shall be determined by the Board of Directors after reviews and recommendations by the Nominating/Compensation Committee, within the limit determined at the Shareholders' Meeting.

- Independence of Outside Directors

- The Company shall establish criteria for independence, based on the requirements of outside directors stipulated in the Companies Act and the independence standards stipulated by the financial instruments exchange.

- Article 5. Business Execution System of the Group

-

- President and Chief Executive Officer

- The President and Chief Executive Officer shall be appointed by the Board of Directors of the Company to supervise the business execution of the Group.

- Executive Board

- An executive board which consists of the executive officers appointed by ANEST IWATA's board of directors will be established to support the decision-making of the president.

- Business Divisions

- The Group shall consist of two business divisions, the Air Energy Division and the Coating Division. Each affiliated company shall be supervised by the relevant business division.

- Functional Divisions

- Each functional division of the Company that does not belong to a business division shall carry out its respective duties and assist in the supervision of affiliated companies by the business division.

Basic Approach to Corporate Governance

We aim to achieve sustained growth and to maximize corporate value. To this end, we consider it imperative to improve the agility and transparency of management and to strengthen oversight of it, and to improve the effectiveness of corporate governance, taking into account the perspectives of shareholders, employees, customers, business partners, and regional communities, among others.

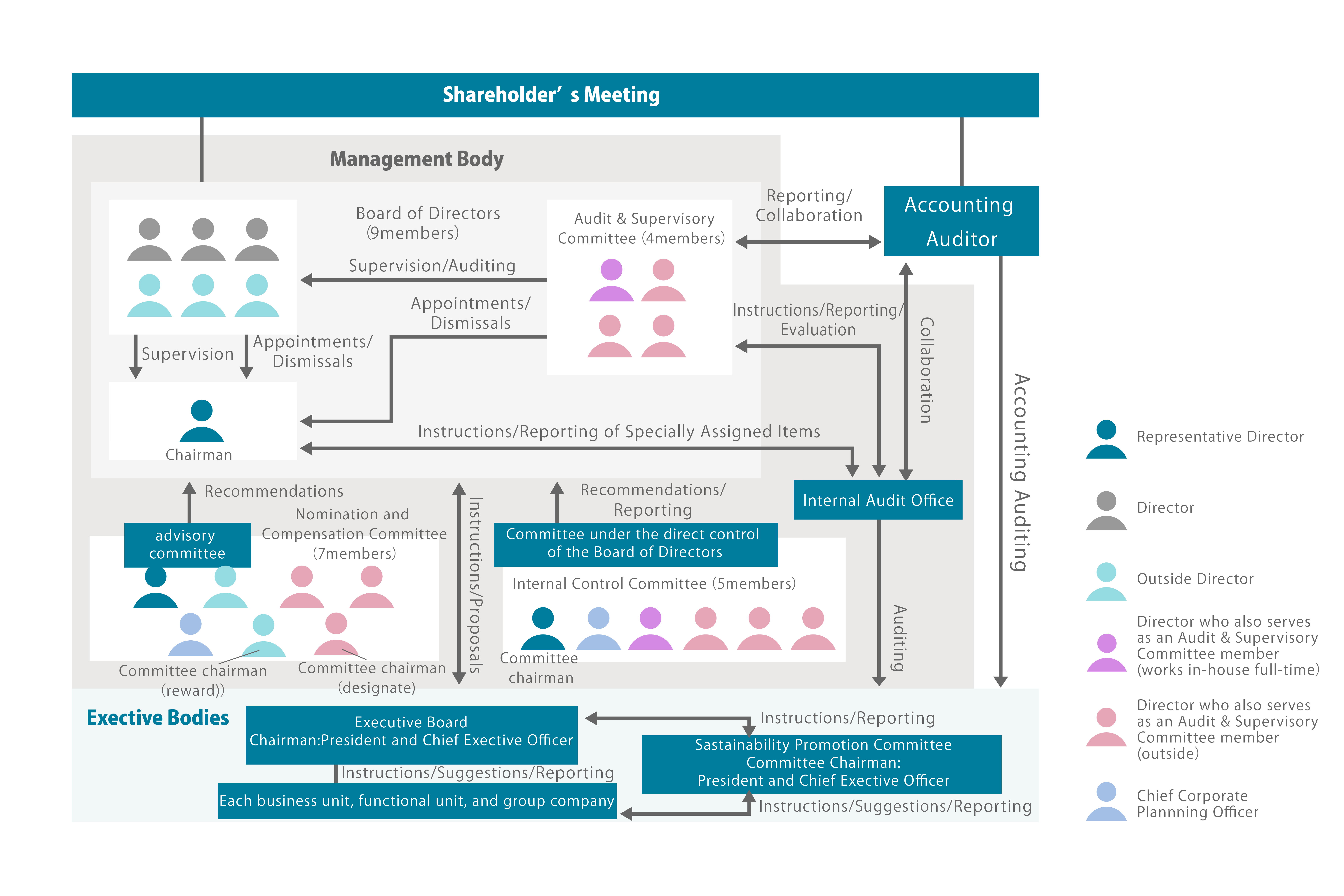

- Corporate Governance System

-

- Board of Directors

- The Board of Directors consists of nine Directors (including five Outside Directors), of whom four are Audit & Supervisory Committee members (including three Outside Directors). The Board of Directors meets at least once a month to make management decisions regarding the company and to receive reports on business execution status, and to monitor and supervise business execution by the Representative Director and Corporate Officers. The Board of Directors consists of up to eleven members, who may be dismissed by a special resolution of the Shareholders' Meeting.

-

- Evaluation of effectiveness of the Board of Directors

- To improve the functions of the Board of Directors, the Company conducts analysis and evaluation of its effectiveness each year. Regarding the issues raised, we will further improve the deliberations by the Board of Directors and raise its effectiveness by utilizing the Board of Directors and the Board of Directors Opinion Exchange Meeting held before and after the Board meetings, through the planning and proposals of the secretariat of the Board of Directors.

- Audit & Supervisory Committee

- The Audit & Supervisory Committee consists of four Audit & Supervisory Committee members (including three Outside Directors). In principle, the Audit & Supervisory Committee meets once a month and access to materials and minutes at important meetings such as Executive Board, and exchanges opinions with Directors and employees on a regular basis, based on the audit policy and audit plan formulated by the Audit & Supervisory Committee. It also works to improve the quality of audits through regular auditing consultations between Accounting Auditors, the Internal Audit Department, and the Audit & Supervisory Committee. Employees who exclusively assist Audit & Supervisory Committee members are assigned to the Internal Audit Department, and belong to the management body of the organization. Expenses necessary for audits by Audit & Supervisory Committee members, including temporary advance payments, are subject to the discretionary approval of the Audit & Supervisory Committee.

- Executive Board

- The Executive Board consists of nine members appointed by the Board of Directors (including the Representative Director, one Directors who also serve as Corporate Officers) and Senior management at the department head level and above. The Executive Board meets at least once a month to support the decision-making of the President and Chief Executive Officer under the management policies approved by the Board of Directors.

- Non-Statutory Committees Within the Management Body of the Organization

-

- 1. Nominating/Compensation Committee

- A non-statutory advisory committee under the Board of Directors, it consists of seven members, the Representative Director, five Outside Directors and Chief Corporate Planning Officer, and is chaired by an Outside Director. The Nominating/Compensation Committee makes recommendations to the Board of Directors regarding nominations for the post of Representative Director and Director, the revision and abolition of compensation rules for the Representative Director and Directors, and the evaluations regarding the Representative Director and Directors who are not members of the Audit & Supervisory Committee.

- 2. Internal Controls Committee

- A non-statutory committee established under the Board of Directors, it consists of six members: the Representative Director, four Directors, and the manager responsible for corporate planning. It is chaired by the Representative Director, and the manager responsible for internal audits assumes the role of the secretariat. It reports to the Board of Directors on the development of policies such as the basic internal control policy, the maintenance policy for the internal control system, and the corporate governance policy, and their quarterly implementation status.

- 4. Accounting Auditor

- The Seinan Audit Corporation is the accounting auditor of the Company.

- Executives

-

We have appointed five Outside Directors (including three Audit & Supervisory Committee members) in order to strengthen the monitoring and oversight of management. Outside Directors are appointed from experts and managers who do not have a material relationship with the company, and through their decisions regarding management from an objective standpoint that is a step removed from the execution of the company's business, we aim to strengthen oversight of the Board of Directors. We believe that Outside Directors, who are members of the Audit & Supervisory Committee, greatly contribute to the effectiveness of our corporate governance by enhancing the independence of the audit system and expressing audit opinions from an objective standpoint.

- Representative Director

-

Eisuke Miyoshi, President and Chief Executive Officer

In addition to his practical experience in the sales division, Mr. Eisuke Miyoshi has played a leading role in streamlining the Group’s operations in recent years from his position overseeing administrative functions, including the human resources and financial & accounting functions. He also has deep insight into new business development and has contributed to strengthening the business foundation that will ensure next-generation growth. For these reasons, we believe that he is an appropriate person to realize the sustainable enhancement of corporate value, and thus propose his appointment as Director.

- Directors

-

Kenichi Osawa, Senior Managing Executive Officer and Chief Operating Officer of Sales Division

In addition to possessing a thorough knowledge of the development of coating equipment and coating systems, Mr. Osawa has led company-wide reforms in recent years aimed at radically overhauling the development and production systems in order to buttress the foundations for the growth of the coating business as a whole. His having led the company's overseas subsidiaries for an extensive period has also given him the insight and high level of expertise necessary for managing a business from a global perspective. Due to such qualities, he is considered the right person capable of sustainably enhancing the value of our company.

Hitoshi Iwata, Managing Executive Officer, Chief Operating Officer of Business Administration Division and General Manager of Corporate Planning Department

He has worked in a wide range of departments at the Company, from business divisionsto administrative divisions, and accumulated a wealth of knowledge regarding overall corporate management. In addition, with his experience of serving as a president of an overseas subsidiary, the Company believes that he has leadership to contribute to the development of the Company as a global company. For these reasons, we believe that he is a suitable person to realize sustainable enhancement of corporate value.

- Outside Directors

-

Makoto Shimamoto

Through his work in the engineering division of a small vehicle manufacturer and involvement in the management of overseas subsidiaries, he has accumulated extensive knowledge. He also has extensive expertise that will help enhance the governance capabilities of the Board of Directors of the Company. As an outside director, he has actively spoken outto enhance the transparency and fairness of our company's management at Board of Directors meetings and advisory committee meetings, as well as appropriately supervising our company's management. For these reasons, we continue to appoint him as a director to supervise the management for the sustainable enhancement of our company's corporate value.

At the conclusion of the General Meeting of Shareholders in June 2025, his term of office as Director will be two year.Takahiro Kanayama

He has extensive knowledge in personnel operations based on his experience of engaging in personnel system design and organizational reform for many years. The Company expects him to contribute to reform of the personnel system and creation of the organizational culture that realize the optimal allocation of human resources and an improvement of motivation, while taking an objective and fair perspective by utilizing his expertise and wealth of experience from the standpoint of Outside Director. We appoint him as a director to supervise management for the sustainable enhancement of our corporate value.

He was appointed as a director at the end of the shareholders' meeting in June 2025. - Audit & Supervisory Executives

-

Audit & Supervisory Committee Members

Katsumi Takeda (Internal, Standing)

Mr. Katsumi Takeda has participated in business operation of coating equipment and coating system over many years, and has contributed to the expansion of coating business by demonstrating a high level of expertise and abundant sales experience. In recent years, he has led and had an established track record in operational reforms, aiming to establish a sales foundation to improve customer satisfaction, in his capacity as head of domestic sales division. For these reasons, we have determined that he is an appropriate person to supervise management and auditthe execution of duties by directors for the sustainable enhancement of our company's corporate value, and we continue to appoint him as a Director and Audit & Supervisory Committee member.

Kazumichi Matsuki (Outside Director)

He has a wealth of experience working for various companies in the manufacturing and other industries, possessingin-depth knowledge in the field of legal affairs and compliance, and hasactively spokenat meetings of the Board of Directors, Advisory Committees, and other committees to enhance the transparency and fairness of the company's management. For these reasons, we have determined that he is an appropriate person to supervise management and audit execution of duties by directors for the sustainable enhancement of our company's corporate value, and we continue to appoint him as a Director and Audit & Supervisory Committee member.

At the conclusion of the General Meeting of Shareholders in June 2024, his term of office as a director will be seven years, five year of which will be as a member of the Audit & Supervisory Committee.Reiko Ohashi(Outside Director)

She has abundant experience and broad knowledge in finance and accounting as a certified public accountant. Since her appointment as an Outside Director of the Company in 2021, she has actively made statements to enhance the transparency and fairness of the management of the Company in the meetings of the Board of Directors, Advisory Committees, and other committees and has appropriately supervised its management. For these reasons, we have determined that she is an appropriate person to supervise management and audit execution of duties by directors for the sustainable enhancement of our company's corporate value, and we continue to appoint her as a Director and Audit & Supervisory Committee member.

At the conclusion of the General Meeting of Shareholders in June 2025, her term of office as a director will be four years, three year of which will be as a member of the Audit & Supervisory Committee.Yuko Shirai

She has abundant experience and broad knowledge in corporate legal affairs as an attorney-at-law. As an Outside Director, she has actively made statements to enhance the transparency and fairness of the management of the Company in the Board of Directors, and has also appropriately supervised its management with independence, from an objective perspective based on the entire corporate community, including laws and regulations. For these reasons, we have determined that she is an appropriate person to supervise management and audit execution of duties by directors for the sustainable enhancement of our company's corporate value, and we appoint her as a Director and Audit & Supervisory Committee member.

At the conclusion of the General Meeting of Shareholders in June 2025, her term of office as a director will be four years, two year of which will be as a member of the Audit & Supervisory Committee. - Limitation of Liability Contract

-

Based on the provisions of Article 427, Paragraph 1 of the Companies Act, our company has signed a contract with non-executive Directors to limit their liability for damages under Article 423, Paragraph 1 of the same Act. The content of the contract limits the extent of liability for damages to the minimum liability amount stipulated in Article 425, Paragraph 1 of the Companies Act, if a Director has acted in good faith and has not been grossly negligent in performing their duties.

- Notable Concurrent Positions Held by Outside Directors

-

- Director Yoshitsugu Asai holds a notable concurrent position in another corporation as stated below. There are no material transactions or any other relationship between our company and the company mentioned below.

- Outside director, Fujimi Incorporated

- Director Makoto Shimamoto does not hold any notable concurrent positions in other corporations.

- Director and Audit & Supervisory Committee member Kazumichi Matsuki holds notable concurrent positions in other corporations as stated below. There are no material transactions or any other relationship between our company and the companies mentioned below.

- Outside director, NISSHA Co., Ltd.

- Outside director of Toyo Construction Co., Ltd.

- Director and Audit & Supervisory Committee member Reiko Ohashi holds notable concurrent positions in other corporations as stated below. There are no material transactions or any other relationship between our company and the companies mentioned below.

- Managing Director of Ohashi Certified Public Accountant Office

- Senior Partner of Audit Corporation Yakumo

- Director and Audit & Supervisory Committee member Yuko Shirai holds notable concurrent positions in other corporations as stated below. There are no material transactions or any other relationship between our company and the companies mentioned below.

- Attorney-at-law

- Outside Director (Audit & Supervisory Committee), Seika Corporation

- Director Yoshitsugu Asai holds a notable concurrent position in another corporation as stated below. There are no material transactions or any other relationship between our company and the company mentioned below.

- Nomination of Candidates for Directorship and the Appointment and Dismissal of Corporate Officers

-

The nomination of candidates for Directorship and the appointment of Corporate Officers are carried out in a highly fair and transparent manner by having the Nominating/Compensation Committee, a non-statutory advisory body, make a recommendation to the Board of Directors based on a consideration of the overall balance of the candidates' knowledge, experience, and capabilities. In addition, if a Corporate Officer is suspected of fraudulence, injustice, or betrayal, or if they are deemed unsuitable as a Corporate Officer for other reasons, the Officer will be relieved of their position by a resolution of the Board of Directors.

- Criteria for Judging the Independence of Independent Directors

-

- Independent Directors must not fall under any of the following.

- Persons involved in the execution of our company's business or that of its subsidiaries (executive Directors and employees), and persons who have been involved in the execution of our company's business in the past.

- Persons whose main business partner is our company or any of its subsidiaries (any of our business partners for which payments received from our company amount to 2% or more of its consolidated net sales for the most recent fiscal year or averaged over the past three years), persons who execute their business, and persons who have executed their business in the past.

- Major business partners of our company or any of its subsidiaries (any of our business partners which account for 2% or more of our company's consolidated net sales for the most recent fiscal year or averaged over the past three years), persons who execute their business, and persons who have executed their business in the past.

- Consultants, accounting professionals, or legal professionals (in case of corporate entities and other organizations, persons who belong to or have belonged to the organization in the past) who receive considerable compensation in money or other assets (JPY 10 million or more per year, or 2% or more of their consolidated net sales, for the most recent fiscal year or averaged over the past three years) from our company or its subsidiaries, apart from executive compensation.

- Major shareholders of our company (shareholders with voting shares of 10% or more) (in case of corporate entities, persons who have executed the business of the corporate entity or have executed the business of the corporate entity in the past).

- Relatives of persons described in a. to e. (relatives up to the second degree, or cohabiting relatives).

- Persons from a company, or its parent company or subsidiary, that has accepted directors from our company or our subsidiaries.

Additionally, “in the past” in a. to d. shall refer to the past described in the standards for independence prescribed by the Exchange.

- Independent Directors must not have possible conflicts of interest even for reasons other than those considered above in Paragraph 1.

- Even if a person falls under Paragraphs 1 and 2 above, if the person is deemed suitable as an Independent Director of our company in light of such aspects as their character and insight, the company may appoint the person as an Independent Director, on the condition that the company provide an explanation to outside parties on the reasons it considers the person suitable as an Independent Director.

- In consideration of their independence, Outside Directors, and Outside Directors who are members of the Audit & Supervisory Committee, shall not be reappointed past eight years of service. However, if the Nominating/Compensation Committee makes a special recommendation in exception of the above, depending on the situation, the Board of Directors may deliberate and make a resolution.

- Independent Directors must not fall under any of the following.

- Compensation for Executives, etc.

-

- Executive Compensation Details (FY3/24)

-

Position Number of Persons Compensated Amount Disbursed:(Million Yen) Directors 9 247 Outside Director 4 23 Audit & Supervisory Committee Members (Directors) 4 42 Audit & Supervisory Committee Members (Outside Directors) 3 24 - Policy for the Determination of Compensation for Directors

-

The basic policy of compensation upholds a compensation system that motivates executives to improve business performance and contribute to the long-term increase in corporate value. The Company’s compensation system comprises a regular sameamount salary (fixed compensation), short-term incentives (performance-linked bonus), and medium- to long-term incentives (performance-linked stock remuneration).Compensation is decidedwithin the limit resolved by the General Meeting of Shareholders,based on the recommendation by the Nominating/Compensation Committee, which is chaired by an Independent Director who is an Audit and Supervisory Committee Member, comprehensively taking into account the Company’s business performance and the responsibilities and achievements of each Director, and upon deliberation of the recommendation by the Board of Directors.

Compensation for Independent Directors comprises exclusively of fixed compensation in order to make them effectively fulfill their management supervision function in consideration of their roles and independence. Compensation for Directors who are Audit and Supervisory Committee Members is determined based on discussions by Directors who are Audit and Supervisory Committee Members.Fixed Compensation

The amount to be paid to each Director as fixed compensation is determined within the limit of the total amount of compensation resolved by the General Meeting of Shareholders, according to the position of the responsibilities of the Director and paid as a monthly salary each month.

At the 77th Annual General Meeting of Shareholders held in June 2023, it was resolved that the total amount of compensation for Directors (excluding Directors who are Audit and Supervisory Committee Members) would be within ¥300 million per year and the total amount of compensation for Directors who are Audit and Supervisory Committee Members would be within ¥60 million per year, in accordance with the 70th Annual General Meeting of Shareholders held in June 2016.Performance-linked Bonuses

The Company pays a performance-linked bonus once a year to the Representative Director and Executive Directors. As an index for calculating the performance-linked bonus, the Company has selected ordinary income for the purpose of assessing the actual status of profit/loss and raising their awareness to contribute to the enhancement of corporate value through the improvement of business performance over the medium- to long-term as well as the improvement of common interests with shareholders.

- Basic Policy Regarding the Persons Who Control Decisions on Financial and Business Policies (Takeover Defense Measures)

-

We have introduced the “Policy on Large-Scale Purchases of our Company's Shares (Takeover Defense Measures)” in 2007, and have abolished this policy at the conclusion of the 78th Ordinary General Meeting of Shareholders held on June 25, 2024.

Since the introduction of this policy, we have worked to build a relationship of trust with the various stakeholders who support us, to enhance our corporate value, and to ensure and enhance the common interests of our shareholders. At the same time, the Board of Directors has unanimously decided to discontinue (abolish) the Policy as it has come to the conclusion that the necessity for takeover defense measures has decreased compared to the initial introduction of the Policy, taking into consideration trends in discussions surrounding the Corporate Governance Code and judicial decisions on large-scale acquisitions.

Report on Corporate Governance [Japanese version only]

For more information on our corporate governance, please refer to the Corporate Governance Report submitted to the Tokyo Stock Exchange.

Compliance Promotion and Anti-Corruption

The Company’s compliance initiatives are overseen by the Legal Department and involve developing and implementing a compliance promotion structure and awareness-raising/educational programs, among others.

Once a year, we provide training to all employees on harassment, accounting irregularities, information leaks and other compliance violations, as well as posters and other means to promote compliance.

- Establishment of point of contact for whistleblowing

-

To mitigate the risk of fraud and promptly identify and address any potentially dubious conduct in accordance with legal requirements, we have established third-party operated hotlines: the "ANEST IWATA Hotline" for domestic employees and the "ANEST IWATA Group Hotline" for employees stationed abroad. These hotlines are designed to receive reports on any illegal activities or violations of company regulations, including harassment, unfair labor practices, information leaks, and corrupt practices.

Our whistleblowing system upholds strict confidentiality regarding the identity of the whistleblowers. It also includes internal regulations that prohibit any unfavorable treatment, such as job transfers, dismissals, or harassment, as a consequence of whistleblowing, thereby ensuring the protection of those who report misconduct. - Achievements in FY2023

-

・Political Donations: ¥0

・Employee Disciplinary Actions or Dismissals due to Corruption: 0 cases

・Fines, Penalties, or Settlement Costs related to Corruption: ¥0